Homeowners Insurance in and around Heber Springs

Looking for homeowners insurance in Heber Springs?

Help cover your home

Would you like to create a personalized homeowners quote?

Insure Your Home With State Farm's Homeowners Insurance

Everyone knows having excellent home insurance is essential in case of a tornado, blizzard or windstorm. But homeowners insurance is about more than covering natural disaster damage. Another helpful thing about home insurance is its ability to protect you in certain legal situations. If someone trips on your property, you could be on the hook for the cost of their recovery or their hospital bills. With good home coverage, these costs may be covered.

Looking for homeowners insurance in Heber Springs?

Help cover your home

Don't Sweat The Small Stuff, We've Got You Covered.

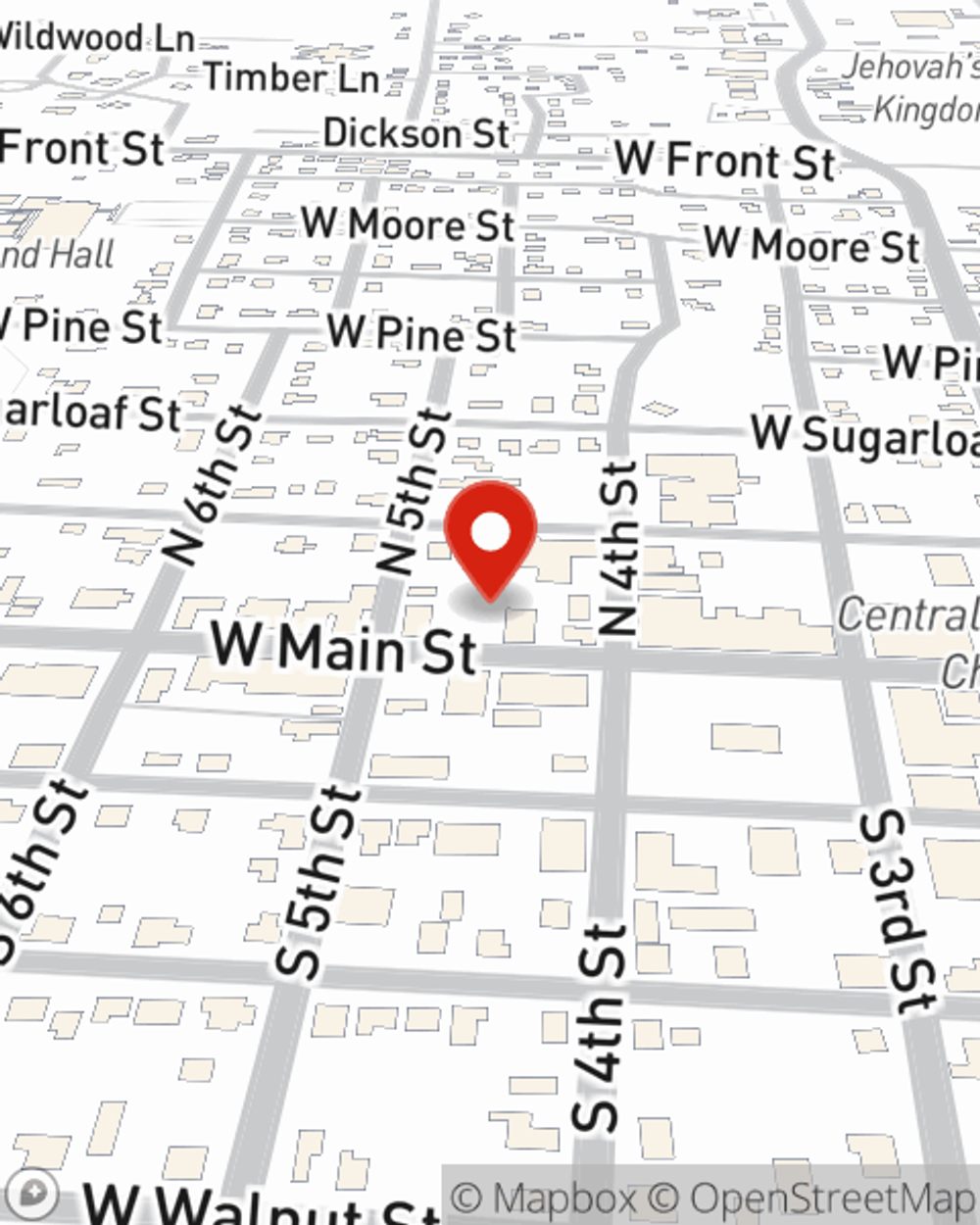

That’s why your friends and neighbors in Heber Springs turn to State Farm Agent Mark Mansfield. Mark Mansfield can explain your liabilities and help you find the most appropriate coverage for you.

For excellent protection for your home and your possessions, check out the coverage options with State Farm. And if you're ready to lay the foundation for a home insurance policy, stop by State Farm agent Mark Mansfield's office today.

Have More Questions About Homeowners Insurance?

Call Mark at (501) 365-3562 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Common rental scams and landlord frauds

Common rental scams and landlord frauds

Rental and landlord scams are more common than you think. Learn ways to tell if a rental is legitimate and how to avoid apartment scams.

Radon gas in homes: What to know

Radon gas in homes: What to know

Radon gas is odorless, colorless and the second leading cause of lung cancer. These are some common methods for assessing, preventing or removing it.

Mark Mansfield

State Farm® Insurance AgentSimple Insights®

Common rental scams and landlord frauds

Common rental scams and landlord frauds

Rental and landlord scams are more common than you think. Learn ways to tell if a rental is legitimate and how to avoid apartment scams.

Radon gas in homes: What to know

Radon gas in homes: What to know

Radon gas is odorless, colorless and the second leading cause of lung cancer. These are some common methods for assessing, preventing or removing it.